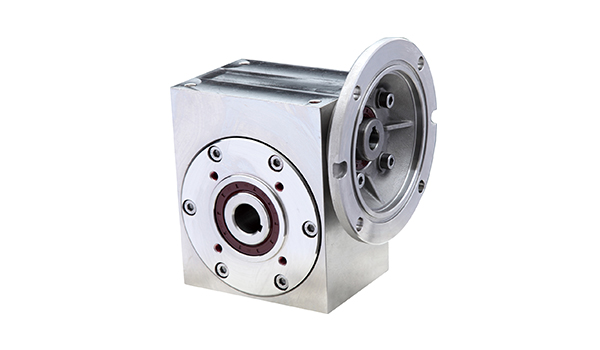

NMRV 蜗杆减速器

线上买球(中国)官方网站:25~150 传动比:7.5~100 输入功率:0...

线上买球(中国)官方网站:25~150 传动比:7.5~100 输入功率:0...

线上买球(中国)官方网站:40~250 传动比:10~60 输入功率:0.1...

线上买球(中国)官方网站:37~97 传动比:6.8~288 输入功率: ...

线上买球(中国)官方网站:SWL1-NMRV30~SWL35-NMRV130...

DWJC-30 DWJC-40 DWJC-50 ...

线上买球(中国)官方网站:040~90 传动比: 7.5~100 传入功率:...